InspireMD Reports Financial Results for the Third Quarter Ended September 30, 2016

– Company to Host Conference Call Today at 4:30pm ET –

BOSTON, MA – November 14, 2016 – InspireMD, Inc. (NYSE MKT: NSPR, NSPR.WS) (“InspireMD” or the “Company”), a leader in embolic prevention systems (EPS), neurovascular devices and thrombus management technologies, today announced financial and operating results for the third quarter and nine months ended September 30, 2016, and provided a business update.

“We have been very active these last few months building a foundation for commercial, corporate, and regulatory success, and executing our strategy for realizing the value of our lead product, the CGuard™ Embolic Prevention System. There continues to be a growing body of data on CGuard, including recent data published in the Journal of Endovascular Therapy and long term follow-up data presented at the Transcatheter Cardiovascular Therapeutics (TCT) 2016 scientific symposium. These clinical data continue to showcase the benefits of this innovative device, including long-term reduction of post-procedural embolization, resulting in less complications for patients,” said James Barry, PhD, Chief Executive Officer of InspireMD. “These important data will help to support our marketing efforts as we look to expand our sales into new geographies and to grow sales in existing areas. Reinforced by the key addition of Agustin Gago as the Company’s new Chief Commercial Officer and plans for an IDE submission in the United States in 2017, InspireMD is poised for growth on several fronts in the coming quarters.”

Recent Highlights:

FINANCIAL

- Closing of a $14.6 million public offering of approximately 442,424 shares of Series B Convertible preferred stock and warrants to purchase up to 1,769,696 shares of common stock (post reverse split)

- Regained compliance with the NYSE MKT listing standards

- Completed 1-to-25 reverse stock split

REGULATORY / CLINICAL / PRODUCT DEVELOPMENT

- Received regulatory approval to commercialize the CGuard™ Embolic Prevention System for the treatment of carotid artery disease in Russia.

- 12-month follow up data from PARADIGM-101, an investigator-initiated clinical trail of CGuard™, were presented at the Transcatheter Cardiovascular Therapeutics (TCT) 2016 scientific symposium in Washington, D.C. The study found device and procedure success were each 99.1%, with vessel narrowing reduced from 83±9% to only 6.7±5%, and 0% peri-procedural death/major stroke/myocardial infarction (MI), along with a normal healing profile at 12 months.

- An independent study titled “Clinical Results and Mechanical Properties of the Carotid CGUARD™ Double-Layered Embolic Prevention Stent,” was published in the Journal of Endovascular Therapy. The study found 100% success in implanting the CGuard™ EPS, no peri- or post-procedural complications, no deaths or major adverse events, and all vessels treated with the CGuard system remained patent (open) at six months.

INTELLECTUAL PROPERTY

- Received Notice of Allowance from the U.S. Patent & Trademark Office for a continuation of a patent titled “Optimized Drug-eluting Stent Assembly.” The parent patent, U.S. Patent No. 9,132,003, was originally issued in September 2015. The previously issued and currently allowed patents cover a stent assembly with the Company’s proprietary MicroNet™ technology that elutes a drug.

EXECUTIVE APPOINTMENTS

- In September, InspireMD appointed Thomas Kester to its Board of Directors and as Chairman of the Company’s Audit Committee. Mr. Kester has 40 years of public accounting experience as well as board member experience of publicly traded companies.

- In October, Agustin Gago was appointed as Executive Vice President and Chief Commercial Officer of InspireMD. Mr. Gago brings over 25 years of industry experience, including senior management positions leading international commercial sales and marketing organizations.

UPCOMING Commercial AND REGULATORY MILESTONES

- Commercial launch of CGuard™ EPS in Brazil in the first half of 2017.

- Commercial launch of CGuard™ EPS in India in the second half of 2017.

- 2017 Investigational Device Exemption (IDE) submission to the FDA.

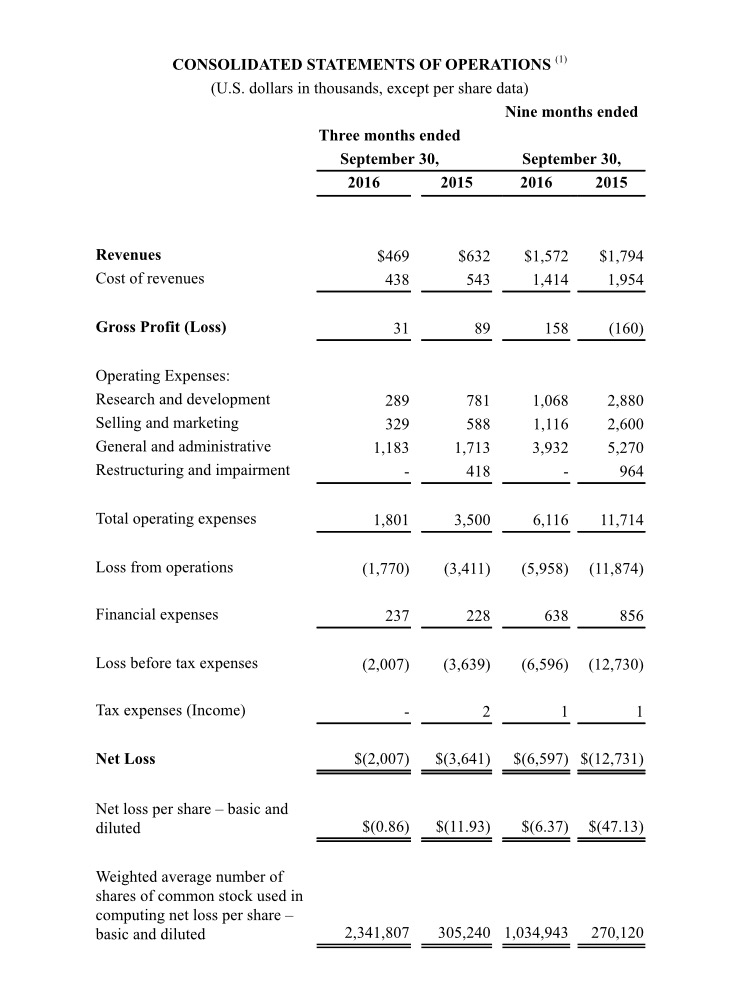

Third Quarter 2016 Financial Results

Revenue for the third quarter ended September 30, 2016 was $469,000 compared to $632,000 during the same period in 2015. The decrease was primarily the result of an expected decline in sales of MGuard™ Prime EPS associated with the trend of doctors increasingly using drug eluting stents rather than bare metal stents in STEMI patients. There was no material change in the sales of CGuard™ EPS, the Company’s carotid product.

The Company’s gross profit for the quarter ended September 30, 2016 was $31,000 compared to $89,000 for the same period in 2015. The decrease in gross profit was largely attributable to a decrease in product revenues and an increase in expenses related to the underutilization of our manufacturing resources, offset by a decrease in labor and material costs attributable to lower revenues.

Total operating expenses for the quarter ended September 30, 2016 were $1,801,000, a decrease of 48.5% compared to $3,500,000 for the same period in 2015. This decrease was primarily due to a reduction of compensation related expenses, consultant fees and other savings associated with our ongoing cost reduction plan.

The loss from operations for the quarter ended September 30, 2016 was $1,770,000, a decrease of 48.1% compared to a loss of $3,411,000 for the same period in 2015.

For the quarter ended September 30, 2016, there was no material change in financial expenses compared to the same period in 2015.

The net loss for the quarter ended September 30, 2016 totaled $2.0 million, or $0.86 per basic and diluted share, compared to a net loss of $3.6 million, or $11.93 per basic and diluted share, in the same period in 2015.

Nine Months Ended September 30, 2016 Financial Results

Revenue for the nine months ended September 30, 2016 was $1,572,000 compared to $1,794,000 during the same period in 2015. The decrease was predominantly driven by an expected decline in sales of MGuard™ Prime EPS associated with the trend of doctors increasingly using drug eluting stents rather than bare metal stents in STEMI patients. This decrease was partially offset by an increase in sales of $415,000 of CGuard™ EPS.

The Company’s gross profit for the nine months ended September 30, 2016 was $158,000 compared to a gross loss of $160,000 for the same period in 2015. This increase in gross profit was largely attributable to a decrease of write-offs of MGuard™ Prime EPS inventory and a decrease in labor and material costs attributable to lower revenues, offset by expenses related to the underutilization of our manufacturing resources and a decrease in product revenues.

Total operating expenses for the nine months ended September 30, 2016 were $6,116,000, a decrease of 47.8% compared to $11,714,000 million for the same period in 2015. This decrease was primarily due to a reduction of compensation related expenses, restructuring and impairment costs, clinical and development expenses and other savings associated with our ongoing cost reduction plan.

The loss from operations for the nine months ended September 30, 2016 was $5,958,000, a decrease of 49.8% compared to a loss of $11,874,000 for the same period in 2015.

Financial expenses for the nine months ended September 30, 2016 were $638,000, a decrease of 25.5% compared to the same period in 2015. This decrease was primarily due to a reduction in interest expense of our outstanding loan.

The net loss for the nine months ended September 30, 2016 totaled $6,597,000, or $6.37 per basic and diluted share, compared to a net loss of $12,731,000, or $47.13 per basic and diluted share, in the same period in 2015.

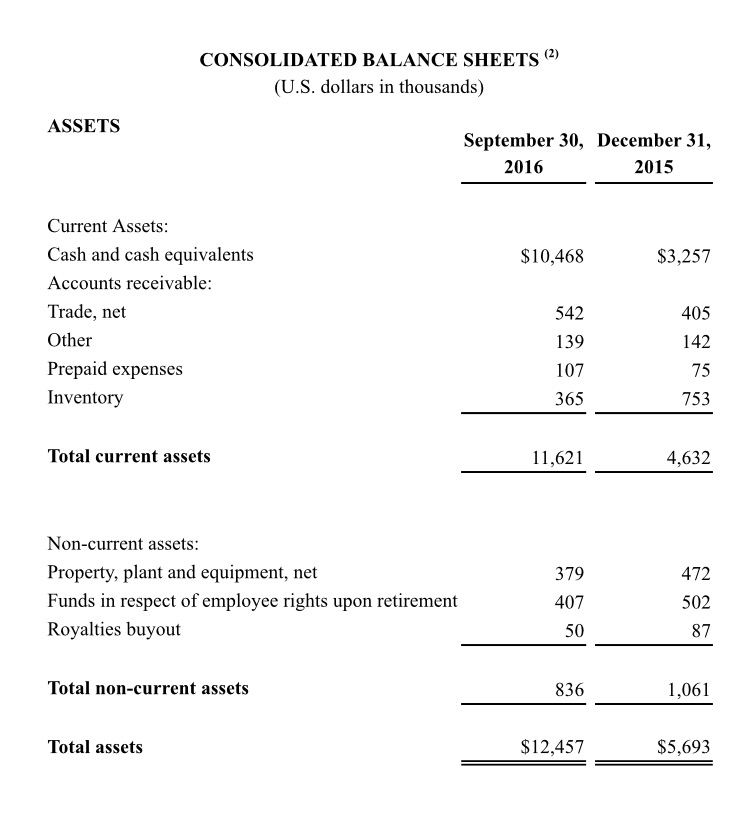

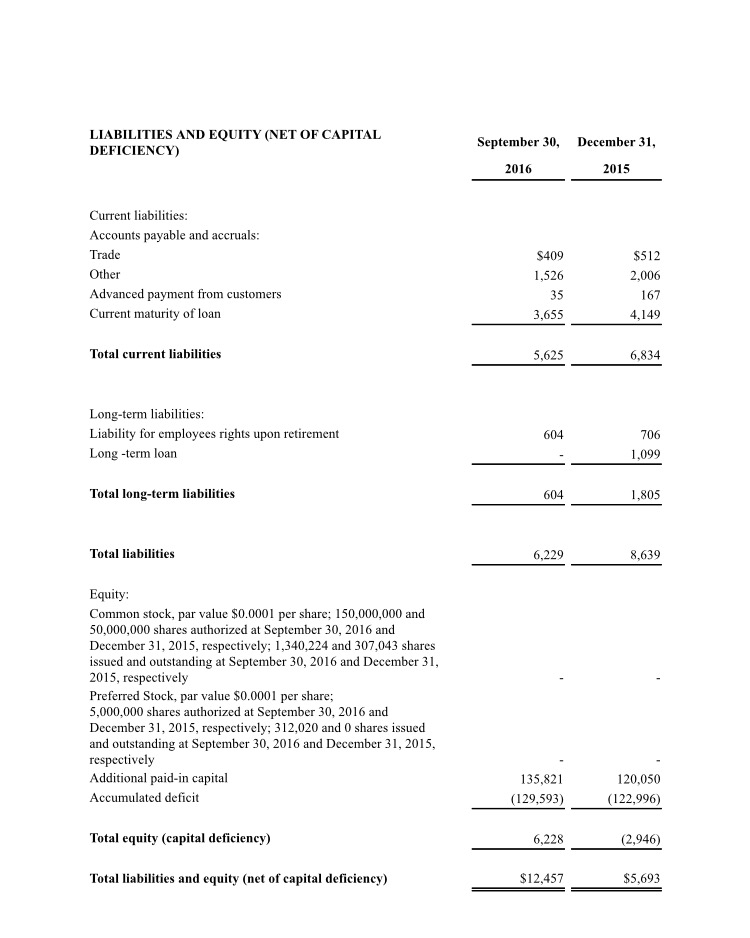

Cash and Cash Equivalents

As of September 30, 2016, cash and cash equivalents were $10,468,000, compared to $3,257,000 as of December 31, 2015.

Conference Call

The company has scheduled a conference call to discuss third quarter 2016 financial results for today at 4:30 pm Eastern Time. To participate in the conference call, please dial 866-652-5200 (United States) or 412-317-6060 (International) and request the InspireMD call. A live webcast will be available in the Investor Relations section of the Company’s website or by clicking here. Please allow 10 minutes prior to the call to visit this site to download and install any necessary audio software.

An archive of the webcast will be available approximately two hours following the call and will be accessible in the Investor Relations section of the Company’s website or by clicking here. A dial-in replay of the call will also be available to those interested until November 28, 2016. To access the replay, dial 877-344-7529 (United States) or 412-317-0088 (International) and enter code 10095759.

About InspireMD, Inc.

InspireMD seeks to utilize its proprietary MicroNet™TM technology to make its products the industry standard for embolic protection and to provide a superior solution to the key clinical issues of current stenting in patients with a high risk of distal embolization, no reflow and major adverse cardiac events.

InspireMD intends to pursue applications of this MicroNet™ technology in coronary, carotid (CGuardTM), neurovascular, and peripheral artery procedures. InspireMD’s common stock is quoted on the NYSE MKT under the ticker symbol NSPR and certain warrants are quoted on the NYSE MKT under the ticker symbol NSPR.WS.

Forward-looking Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) market acceptance of our existing and new products, (ii) negative clinical trial results or lengthy product delays in key markets, (iii) an inability to secure regulatory approvals for the sale of our products, (iv) intense competition in the medical device industry from much larger, multinational companies, (v) product liability claims, (vi) product malfunctions, (vii) our limited manufacturing capabilities and reliance on subcontractors for assistance, (viii) insufficient or inadequate reimbursement by governmental and other third party payers for our products, (ix) our efforts to successfully obtain and maintain intellectual property protection covering our products, which may not be successful, (x) legislative or regulatory reform of the healthcare system in both the U.S. and foreign jurisdictions, (xi) our reliance on single suppliers for certain product components, (xii) the fact that we will need to raise additional capital to meet our business requirements in the future and that such capital raising may be costly, dilutive or difficult to obtain and (xiii) the fact that we conduct business in multiple foreign jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical and communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction. More detailed information about the Company and the risk factors that may affect the realization of forward looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Investor Contacts:

InspireMD, Inc.

Craig Shore

Chief Financial Officer

Phone: 1-888-776-6804 FREE

Email: craigs@inspiremd.com

Lazar Partners

David Carey

Investor Relations

(212) 867-1768

Email: dcarey@lazarpartners.com

(1) All 2016 financial information is derived from the Company’s 2016 unaudited financial statements, as disclosed in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission, all 2015 financial information is derived from the Company’s 2015 unaudited financial statements, as disclosed in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission.

2) All September 30, 2016 financial information is derived from the Company’s 2016 unaudited financial statements, as disclosed in the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission. All December 31, 2015 financial information is derived from the Company’s 2015 audited financial statements as disclosed in the Company’s Annual Report on Form 10-K, for the twelve months ended December 31, 2015 filed with the Securities and Exchange Commission.